I received a brochure from an English enrichment class near my home. I was super impressed because of the great advice it gives to students - Show, don't tell. Basically that advice - for good writing to students - means that instead of saying that John is smart, you say everything that describes why he is smart. In other words, you show, you don't tell. I'll probably write something that goes like this: John can solve problems at a snap of a finger; problems that normally take others a good while to figure out.

I was pretty impressed! I thought in life, we should do all that. You know the thing about communications in Singapore, especially Singlish, is that we tend to jump to the point very fast and efficient. We Singaporeans are man (or woman) of few words, and some say fewer emotions.

Examples? Here we go:

1. What you want? (imagine the position of your hand with palms facing down, then you flip it up at the same time you raise your chin)

2. Makan? (coupled with a gesture of the index and middle fingers pointing out like a chopsticks, scooping imaginary rice into your mouth)

3. Makaned. (with hands rubbing your belly)

I think we should be less efficient. Talk more, describe more, show more instead of just telling. Try telling your boss everything except saying that you need a raise in salary. Try telling your wife everything except saying that you love her. Try writing in your resume everything except that you are hardworking, creative, smart and have good management skills. For the stock gurus, try showing more results instead of telling, haha!

It might very well change your life :)

I was pretty impressed! I thought in life, we should do all that. You know the thing about communications in Singapore, especially Singlish, is that we tend to jump to the point very fast and efficient. We Singaporeans are man (or woman) of few words, and some say fewer emotions.

Examples? Here we go:

1. What you want? (imagine the position of your hand with palms facing down, then you flip it up at the same time you raise your chin)

2. Makan? (coupled with a gesture of the index and middle fingers pointing out like a chopsticks, scooping imaginary rice into your mouth)

3. Makaned. (with hands rubbing your belly)

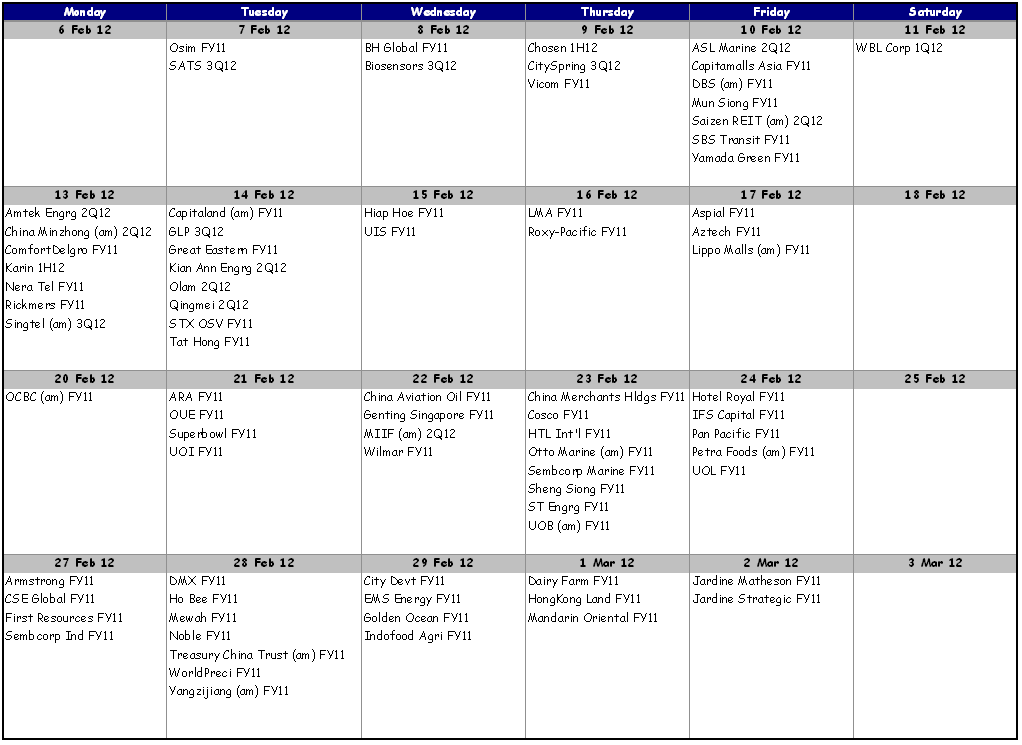

I think we should be less efficient. Talk more, describe more, show more instead of just telling. Try telling your boss everything except saying that you need a raise in salary. Try telling your wife everything except saying that you love her. Try writing in your resume everything except that you are hardworking, creative, smart and have good management skills. For the stock gurus, try showing more results instead of telling, haha!

It might very well change your life :)