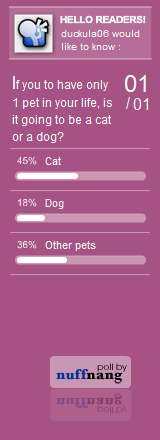

I made a poll not too long ago, so I think it's appropriate to conclude it after 1-2 weeks. After a turnout of 11 responses, here's the results:

It's quite surprising to me because I thought more people would love dogs, judging by how people treat dogs as a better companion than cats. Nevertheless, cats win this time round!

In my line of work, it's more usual for me to encounter dogs than cats. I've only have 1 household that keep cats (but they also keep dogs)...1 out of so many many household over so many years! But pets are cute actually, I've befriended quite a few dogs. Whenever I go over to the place, they would recognise me and greet me in the usual dog fashion :)

Here's some cute and funny pictures that I snapped using my lousy hp camera:

The above picture is a very funny picture I've seen of Mikey. When I first met him, he was growling at me. But after getting to know each other for sometime, he would greet me by grabbing his favourite toy and follow me around, before lying down to sleep near me (and the student). This is one of the funniest pose I've seen Mikey do. I thought cats would do this kind of funny pose, apparently I'm wrong :)

This is a very very interesting cat. She would follow people to the lift and would stay in a corner to sleep, riding the lift up and down. I call her the lift cat. She had caught me off guard twice, when after a tiring day of work, I entered the lift and see a bundle of fur all cuddled up in the corner of the lift. How can my heart not melt and give it a cat's rub?

Ah...the simple pleasures of life.

It's quite surprising to me because I thought more people would love dogs, judging by how people treat dogs as a better companion than cats. Nevertheless, cats win this time round!

In my line of work, it's more usual for me to encounter dogs than cats. I've only have 1 household that keep cats (but they also keep dogs)...1 out of so many many household over so many years! But pets are cute actually, I've befriended quite a few dogs. Whenever I go over to the place, they would recognise me and greet me in the usual dog fashion :)

Here's some cute and funny pictures that I snapped using my lousy hp camera:

|

| Erm...let sleeping dogs lie? |

The above picture is a very funny picture I've seen of Mikey. When I first met him, he was growling at me. But after getting to know each other for sometime, he would greet me by grabbing his favourite toy and follow me around, before lying down to sleep near me (and the student). This is one of the funniest pose I've seen Mikey do. I thought cats would do this kind of funny pose, apparently I'm wrong :)

|

| A bundle of fur in a corner of the lift |

This is a very very interesting cat. She would follow people to the lift and would stay in a corner to sleep, riding the lift up and down. I call her the lift cat. She had caught me off guard twice, when after a tiring day of work, I entered the lift and see a bundle of fur all cuddled up in the corner of the lift. How can my heart not melt and give it a cat's rub?

Ah...the simple pleasures of life.